Chinese Currency Revaluation (货币升值) Posted by Stephen on Aug 22, 2011 in News, Uncategorized

After much anticipation and coupled with foreign and domestic pressure (not to mention the US Debt ceiling fiasco), China is finally poised to begin allowing a “gradual” appreciation of its currency against the U.S. dollar.

After much anticipation and coupled with foreign and domestic pressure (not to mention the US Debt ceiling fiasco), China is finally poised to begin allowing a “gradual” appreciation of its currency against the U.S. dollar.

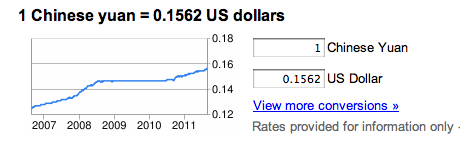

Currency revaluation or 货币升值 (huòbìshēngzhí), has been a key issue for China and the rest of the world, as China has sought to keep exports inexpensive, thus stimulating GDP and growth through currency manipulation. Western nations have argued that artificial depreciation of currency (pegging it to a basket of currencies) is harmful in a global economy, as it has taken away competition from other goods produced outside of China.

Yet, it is mainly pressure from within the mainland, caused by inflation or 通长 (tōng zhàng), worker strikes and a housing bubble, that is now precipitating this move to allow a gradual 逐渐的 (zhújiàn de) float against the dollar.After all, years of rampant GDP (国内生产总值 guónèi shēngchǎn zǒngzhí) growth means a rapid rise in cost of living. By keeping the renminbi artificially low, citizens of China were bolstering their exports, but limiting the purchasing power of their wages.

Not all pressure for a gradual currency rise has come from within Chinese borders. For the past decade and a half, the U.S., E.U. and a host of other G20 countries have been pleading with Beijing to revalue its currency. By their logic, manipulating the renminbi to be artificially low takes away jobs from other nations with slightly higher overheads and costs of business, harking on the South Park joke: “They took our jobs!”.

History buffs will note that this is quite similar to what the U.S. and Europe were saying during the 1980’s and early 90’s about Japan and its government-sponsored industries…and we all know how that turned out for Japan’s long term growth. Yet, in terms of the bigger picture (globally), this revaluation will mark a fundamental change in the development of China’s economy, likely allowing the rest of the world to increase exports and hopefully pull itself out of this recession,不景气 (bù jǐng qi), while allowing China to focus inward on a consumer base of 1.4 billion.

Even though the revaluation is supposed to be incremental and over a long period of time, it is an immediate blessing for many Chinese and 老外 living in the country, who have watched as food, housing and services have skyrocketed the last few years. Not only will they be able to purchase more with the same 块, but imports will likely drop in price as they become more competitive, allowing for more foreign goods to be bought within the mainland. For anyone who has bought a less-than-quality good from China, this means more high end products at lower prices.

Still, China holds a huge amount of U.S. debt in the form of T-bonds and U.S. dollar assets (although less now following the US debt ceiling debacle). Naturally, if the renminbi appreciates against the dollar, those reserves will decline slightly in value, hurting government balance sheets. Hopefully for the Chinese government, this will be offset by increases to the dollar’s value (as exports and the US economy improve). The questions still persist: How smoothly can China make the revaluation and transition to a consumer economy? Will they go the way of Japan or will they blossom as a domestic market? Stay tuned.

Follow Steve on twitter: @seeitbelieveit

Build vocabulary, practice pronunciation, and more with Transparent Language Online. Available anytime, anywhere, on any device.

About the Author: Stephen

Writer and blogger for all things China related. Follow me on twitter: @seeitbelieveit -- My Background: Fluent Mandarin speaker with 3+ years working, living, studying and teaching throughout the mainland. Student of Kung Fu and avid photographer and documentarian.

Leave a comment: